The All-Stocks network is a distributed stock exchange platform-review BEST ICO 2018

The All-Stocks network is a distributed stock exchange platform

The All-Stocks network is a distributed stock exchange platform which aims to interface with all major stock exchanges and stock brokers around the world. All stakeholders will be able to trade with the platform’s ERC 20 compliant tokens.

This network will create a decentralized system, which will allow all stakeholders to trade with a token that complies with the ERC20 standard. This backup asset will be stored in your escrow account. In addition, the network will allow users to trade financial assets (such as currency and bonds) on Blockchain technology

INFRASTRUCTURE

All-Stocks has an excellent infrastructure to support the smooth running of this project.

Infrastructure ALLSTOCKS will be organized in such a way that important data will be stored in Blockchain. The stored data are user balances and transactions. While data is maintained in Blockchain, all other data will be stored on the server.

To enable the adoption of CTT, the development, framework, and rapid development environment have been designed. Also, some smart contracts will be required for the system to perform optimally. Platform users need to store and use Ethereum wallets.

To facilitate the use of CTT transactions, hedging and investment tools, user-friendly libraries and codes will be required. Regarding the smart contract CTT, all smart contract CTTs will meet ERC — 20, which means that they will work well in Blockch ain Ethereum. In the meantime, smart contracts ALLSTOCKS (also called crypto contracts) will be dedicated to managing the smart contract work of CTT.

Infrastruktur On-chain: ALLSTOCKS network of smart contracts are required to work optimally.

CTT Smart Contracts : Each real financial asset registered with ALLSTOCKS Decentral Stock Exchange will have CTT issued in the form of smart contracts. CTT smart contracts, on the other hand, will be ERC20-compliant. Forwarding CTTs between accounts will be the same as transferring ERC20 tokens between users’ wallets.

ALLSTOCKS Decentral Stock Exchange: In order to regulate the work of CTT Cryptocontracts, a dedicated Decentral Stock Exchange for Cryptocontracts will be tasked with such responsibility.

Buffers: Also known as Auxiliary Smart Contracts, the buffers will help perform auxiliary functions such as switching between cryptocontracts running different versions and enabling extra API functions. Off-chain Infrastructure: To facilitate the speedy adoption of CTT as a hedging tool, transaction and investment, certain libraries and code templates for app developers will be made available.

Toolkits: These are tools created for the sole purpose of interfacing the internal CTT Limited’s IT infrastructure with Ethereum Blockchain. In summary, it helps to organize the interaction as well as monitor the state of the ALLSTOCKS system.

CTT Explorers: CTT Explorers will be created to allow users view CTT data and manually verify the right ownership of underlying real financial assets of ALLSTOCKS Decentral Stock Exchange.

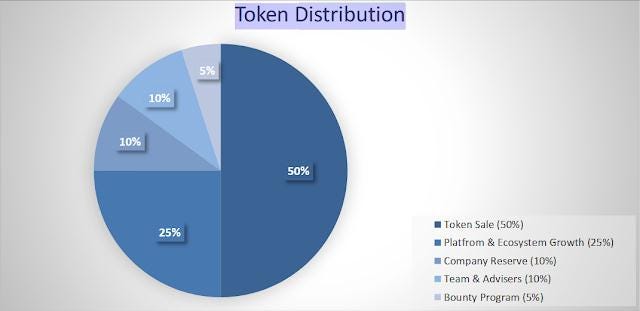

TOKEN SALE INFO :

SUPPLAY TOKEN : 50.000.000

TOKEN SELL : 25.000.000

TOKEN SYMBOL : AST

ACCEPTED CURRENCIES : ETH

1 ETH = 500 AST

SOFTCAP = 2,500,000 AST

HARDCAP = 25,000,000 AST

TOKEN SALE DATE :

PRE-ICO (25% Bonus) 15 APRIL 2018–30 APRIL 2018

ICO Level 1 (10% Bonus) 1 May 2018–15 Juni 2018

ICO Level 2 (0% Bonus) 16 JUNI 2018–30 JUNI 2018

MORE INFO :

WEB : https://all-stocks.net/

Whitepaper: https://all-stocks.net/wp-content/uploads/2018/03/Allstocks_whitepaper_rectified.pdf

Twitter: https://twitter.com/AllStocks_ico

Facebook: https://www.facebook.com/gobalstocks/

Reddit: https://www.reddit.com/r/AllStocksNetwork/

Telegram Group: https://t.me/all_stocks_ico

Bitcointalk Thread: https://bitcointalk.org/index.php?topic=3177904.1820

Bitcointalk ANN Thread : https://bitcointalk.org/index.php?topic=3210865.0

linkedin : https://www.linkedin.com/company/allstocks-network/

Instagram :https://www.instagram.com/allstocks1137/

Whitepaper: https://all-stocks.net/wp-content/uploads/2018/03/Allstocks_whitepaper_rectified.pdf

Twitter: https://twitter.com/AllStocks_ico

Facebook: https://www.facebook.com/gobalstocks/

Reddit: https://www.reddit.com/r/AllStocksNetwork/

Telegram Group: https://t.me/all_stocks_ico

Bitcointalk Thread: https://bitcointalk.org/index.php?topic=3177904.1820

Bitcointalk ANN Thread : https://bitcointalk.org/index.php?topic=3210865.0

linkedin : https://www.linkedin.com/company/allstocks-network/

Instagram :https://www.instagram.com/allstocks1137/

AllStocks Office:

Ramat-Gan (Tel-Aviv Area), Israel

33th Jabotinsky St,

1st Twins Tower, 11th floor

Tel – 073-7328345

Email: Support@All-Stocks.net

Web: All-Stocks.net

Comments

Post a Comment